The name Vedartha is derived from two Sanskrit words - Veda, embodying the timeless pursuit of wisdom through knowledge, and Artha, signifying prosperity through purposeful wealth creation. Together, they reflect a philosophy where expertise drives prosperity, and wealth becomes a means to create enduring impact.

Vedartha opens the door to a world of traditional and AI-based opportunities through a suite of Alternate Investment Funds (AIF) and Portfolio Management Services (PMS), across equity and fixed income.

Our investment philosophy is built on identifying high-potential opportunities, crafting pertinent strategies, and constructing portfolios—all while delivering unparalleled service to meet your distinct goals.

With Vedartha, you benefit from the expertise of one of India’s most seasoned fund management teams, and the backing of Bandhan AMC, a fund house with a 25-year legacy.

About UsThe R.I.S.E. Strategy

At Vedartha, we deploy a specific, well-thought-out strategy that helps us identify attractive investment opportunities. We call it R.I.S.E.

Resilient Industries: Choose industries with a proven track record of consistent growth and resilience to economic fluctuations

Innovation First: Prioritise companies leveraging cutting-edge technologies to enhance efficiency, productivity, and scalability across sectors

Sustainable Growth: Target sectors poised for rapid expansion driven by consumer demand and infrastructure development in India

Emerging Opportunities: Leverage early trends in sectors aligned with evolving consumer preferences and government-led growth initiatives

Our R.I.S.E strategy enables us to make the most of market opportunities in the face of changes and unpredictability, leading to long-term wealth creation potential for our clients.

At the Helm

Mrinal Singh,

Head - Alternates (Listed Equities)

Mrinal Singh, Head – Alternates (Listed Equities) at Bandhan AMC, brings over two decades of experience and a successful track record in investment management and equity research. Renowned for his value-driven approach to fund management, he has built a strong reputation for his deep research expertise, meticulous stock-picking, and long-term-oriented investment philosophy, that has delivered sustained outperformance across the funds he has managed.

Before joining Bandhan AMC, Mrinal was the CIO & CEO of InCred Asset Management, where he oversaw the company’s investment strategy and portfolio management. Prior to that, he served as the Deputy CIO at ICICI Prudential AMC for over 12 years, and was instrumental in building the AMC’s research processes, product strategy as well as business and talent development. At ICICI Prudential AMC, Mrinal managed assets of $3.3 billion, including some of the largest flagship funds. Under his leadership, the ICICI Prudential Value Discovery Fund grew from $0.2 billion to $2.7 billion.

An alumnus of SP Jain Institute of Management & Research, Mumbai, Mrinal is committed to promoting financial literacy and education across the country. He is a vocal advocate for empowering individuals with the knowledge and skills needed to make informed financial decisions and achieve their financial goals.

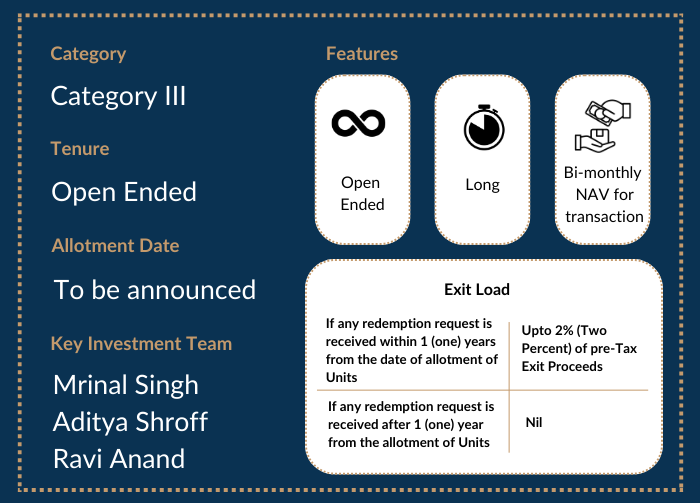

Fund

Vedartha Equity

Opportunities Fund

An open-ended scheme of Bandhan India Equity Hedge Fund registered with Securities and Exchange Board of India (SEBI) as Category III Alternative Investment Fund.

Objective

The fund operates as an open-ended Category III AIF, managing investments in accordance with its objective of delivering returns to contributors under applicable laws and fund documents.

Its primary objective is to achieve long-term capital appreciation by investing in listed equities and equity-related securities across various market capitalisations and sectors.

Investment Framework

Our investment strategy follows a disciplined framework that identifies and capitalises on prevailing market inefficiencies with a focus on simplicity, timeliness, and efficiency. We aim to deliver superior risk-adjusted returns by constructing a concentrated yet diversified portfolio of 20-30 high-quality stocks, designed for a long-term horizon of 3-5 years with a low churn rate.

Key Pillars of Our Framework

1. Business Evaluation

-

Focus on scalable, sustainable, and competitive business models with strong corporate governance.

-

Prioritise industries with favourable economic environments, value migration, and robust growth drivers.

-

Identify companies capable of growing earnings faster than inflation, with significant market opportunities.

2. Management Analysis

-

Assess management stability, professional expertise, and alignment of interests through insider activity.

-

Evaluate operational efficiency, strategic vision, and responsiveness to market feedback.

-

Focus on clarity, consistency, and a strong track record in investor communication.

3. Valuation Focus

-

Invest at a substantial discount to intrinsic value while ensuring a margin of safety.

-

Target companies with excess returns on capital employed and strong free cash flow generation.

-

Conduct rigorous risk-return analysis to identify opportunities with high growth and profitability potential.

This strategic approach enables us to participate in India’s growth story by investing in structural themes and market leaders across high-growth sectors with significant entry barriers. Our focus remains on building a resilient portfolio aligned with long-term wealth creation for our investors.